Overview of the S-REIT Industry

- Singapore has the largest REIT market in Asia (ex-Japan) and is increasingly becoming a global REIT hub.

- There are 38 traded Singapore REITs (S-REITs) and Property Trusts with a total market capitalisation of approximately S$100 billion.

- S-REITs are an important component of Singapore’s stock market and comprise around 10% of the Singapore Exchange’s market capitalisation.

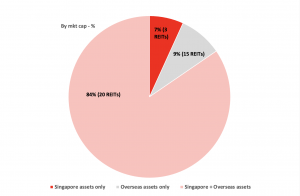

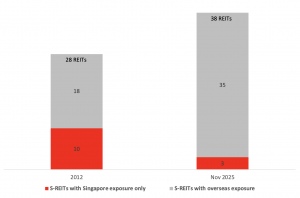

- Over 90% of S-REITs and Property Trusts (by both number and market capitalization) own properties outside Singapore across Asia Pacific, South Asia, Europe and USA. There are 15 S-REITs whose real estate portfolios comprise entirely of overseas properties.

- S-REITs that own Singapore real estate properties are required to distribute at least 90% of their specified taxable income (generally income derived from the Singapore real estate properties) to unitholders in order to qualify for tax transparency treatment.

- S-REITs pay quarterly or semi-annual distributions.

| Country | REIT market cap (US$bil) | % of stock market cap |

|---|---|---|

| Singapore | 76 | 10.0% |

| Australia | 126 | 6.7% |

| Belgium | 24 | 4.3% |

| Malaysia | 13 | 2.9% |

| United Kingdom | 69 | 1.9% |

| United States | 1,275 | 1.8% |

| Japan | 112 | 1.5% |

| Canada | 51 | 1.3% |

| France | 44 | 1.3% |

| India | 20 | 0.4% |

| S.Korea | 7 | 0.3% |

| Hong Kong | 18 | 0.2% |

| China | 11 | 0.1% |

-

- Source: Singapore data from SGX Chartbook: SREITs & Property Trusts as at 30 September 2025

- Rest of the countries: EPRA Global Real Estate Total Markets Table, Q3 2025

- For a complete list of S-REITs with their market capitalisation, portfolio value and country exposure please click here.

The Monetary Authority of Singapore (MAS) has made constant effort to strengthen corporate governance in the S-REIT industry, including, among others, requiring REIT managers and directors to prioritise investors’ interests over those of the manager and the sponsor in the event of conflicts of interest. Good corporate governance helps to provide safeguards for investors and unitholders while facilitating the growth of the REIT market in Singapore.

REITs listed on the SGX are granted tax transparency treatment generally on rental and related income from Singapore real estate properties. For those investing in foreign properties, they (including the REITs’ wholly-owned Singapore-resident subsidiaries) are currently exempt from taxation on certain foreign income derived in respect of those properties acquired on or before 31 March 2020. This was part of a package of tax incentives introduced by the Singapore government to develop Singapore as the preferred Asian listing destination for REITs.

In order to promote REIT ETFs, the Singapore government announced during the 2018 Budget that S-REIT ETFs would no longer be subject to a withholding tax of 17% and would be granted tax transparency treatment, thereby maintaining parity in tax treatments between investing in individual S-REITs and REIT ETFs. Also, a 10% concessionary tax rate was introduced on REIT ETF’s distributions received by qualifying foreign corporate individuals. These tax incentives enhance Singapore’s competitiveness and maturity as a REIT market.

As at August 2025, over 90% of S-REITs and property trusts (by both number and market capitalisation) own properties outside Singapore. The trend of acquiring assets outside Singapore has intensified in recent years as REIT managers have looked beyond the geographically small city state in search of yield-accretive acquisitions. Some S-REITs with overseas exposure have widened their investment mandates to expand their geographical reach. Investing in S-REITs thus allows investors to get exposure to properties around the world.

S-REITs have provided long term sustainable total returns and dividend yields which are generally more favourable compared to REITs in other established markets.

a) Total return: The FTSE ST REIT Index delivered total returns of -3.0% and -0.9% over the 5-year and 1-year period respectively. In 1Q 2025, it recorded an increase of 3.8%.

b) Dividend yield: The average current dividend yield of S-REITs was 6.9% at the 28 February 2025. This compares with the 10-year Singapore benchmark government bond yield of 2.7%.

Average Dividend yield by Sector

The S-REIT market is well-diversified across different sub-sectors. Lately, the trend has been of REITs diversifying to more than one asset class with the result that “diversified” REITs now account for more than half of all S-REITs.

S-REITS are diversified across different asset classes

Source: Company reports, REITAS, as at November 2025

More data and charts on S-REITs is available at SGX’s Chartbook available here